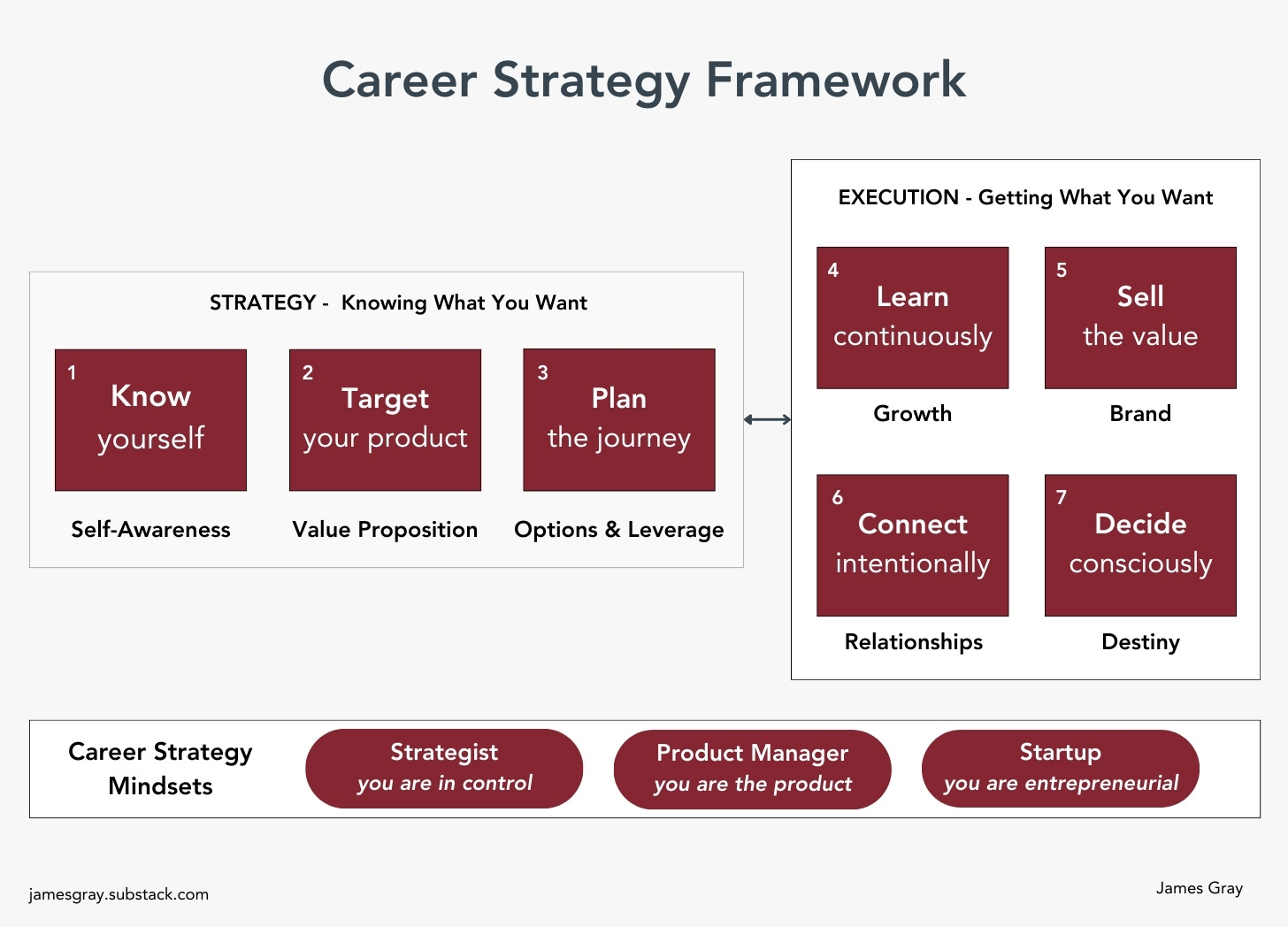

Career Strategy Framework

A playbook of strategies to shape a unique career of meaning, impact, and fulfillment.

This framework is a collection of first principles for strategically managing a career that delivers outcomes such as fulfillment, meaning, and the rewards that are most important to you.

You must do these simple things:

Know yourself and your life vision (Strategy 1).

Target your time, effort, and best self to valuable problems that align with your purpose and sustainably compensate you (Strategy 2).

Plan a career journey to build a strong position that mitigates external forces, knowing it will be long, challenging, and uncertain (Strategy 3).

Continually learn valuable skills and sustain unique, scarce expertise (Strategy 4).

Sell your brand with authority and credibility to maximize demand for your unique expertise (Strategy 5).

Connect and develop strong relationships with people who can help you throughout your career. (Strategy 6).

Make sound decisions that align with your character, vision, and purpose. (Strategy 7).

These first principles will stand the test of time.

Scenario Guides

Scenarios guides use the framework concepts to apply them to common situations practically:

❤️ Strategy 1 - Know Yourself

Discover and align your inner world to catalyze a transformation.

Know Your Principles - your rules for making decisions to get what you want (coming soon!)

Know Your Skills and Weaknesses - your competencies, experiences, weaknesses, and blind spots (coming soon!)

🎯 Strategy 2 - Target Your Product

Strategically identify a unique, profitable market opportunity in which you can offer a compelling value proposition that aligns with your vision.

Target by Experimenting and Adapting to Product/Market Fit (coming soon!)

Target Your Product with a Personal Value Proposition (coming soon!)

🧭 Strategy 3 - Plan the Journey

Create plans and mindsets to achieve your long-term goals on a journey that will be hard and full of change.

Plan for Obstacles and Failures (coming soon!)

Plan to Burn the Boat (coming soon!) - key nuggets from Burn the Boat by Matt Higgins

Plan Your Environment or Your Environment Will Plan You (coming soon!)

Plan a Transformational Experience to Accelerate Your Path (coming soon!)

Plan Rituals and Routines (coming soon!)

Plan Your Personal Board of Directors (coming soon!)

🧠 Strategy 4 - Learn Continuously

Invest in your value proposition and expertise by learning on the job, from others, and self-learning to sustain relevancy.

Learn from Your Decisions (coming soon!)

Learn Through Experimentation (coming soon!)

Learn the Realities of Human Nature: Your Life Depends on It (coming soon!)

💰Strategy 5 - Sell the Value

Market your brand often to build the credibility and power required to achieve your vision.

Sell to Influence and Negotiate (coming soon!)

Sell to Make Your Value Proposition Believable (coming soon!)

Sell to Increase the Surface Area of Luck (coming soon!)

Sell Your Product with Massive Distribution (coming soon!)

🤝 Strategy 6 - Connect Intentionally

Build human connections to guide and support your journey.

Connect with an Accountability Partner to Deliver on Your Commitment (coming soon!)

Connect to Help Others Unconditionally – Pay It Forward (coming soon!)

✅ Strategy 7 - Decide Consciously

Make quality decisions that align with your vision.

Decide the Essential (coming soon!)

Decide Your Actions by Keeping Score (coming soon!)

Decide From a Higher Perspective (coming soon!)